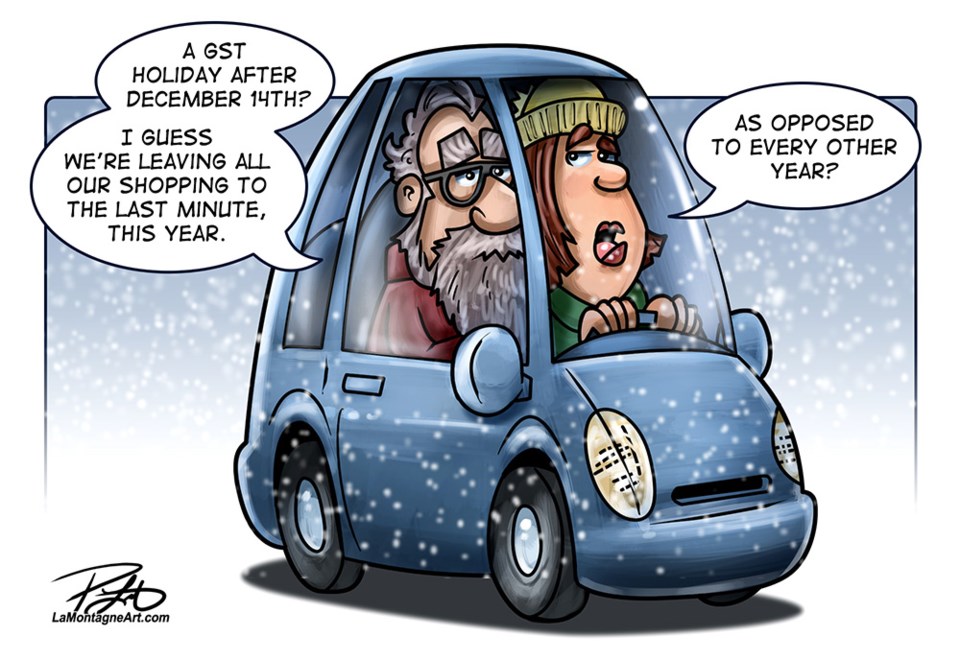

A recent announcement by the federal government regarding a GST holiday has sparked debate. Eliminating the tax temporarily might seem like a win for consumers, but potential benefits should be weighed against possible drawbacks.

A break from paying GST on certain items could provide a financial boost to qathet region residents enduring a high cost of living, and a reduction in goods and services prices will enable families to stretch their budgets further during the holiday season, but how long will that last? We’re talking about a marginal savings of five per cent per purchase, and the tax will be back in February.

Retailers might experience a surge in sales as customers take advantage of the temporary tax relief, which could help with economic recovery. Again, it’s temporary, so what, if any, are the long-term benefits?

The policy can be viewed as disproportionately benefitting higher-income earners who spend more on discretionary goods, while providing limited relief to low-income families whose purchases often include already tax-exempt essentials such as basic groceries.

While a GST holiday might bring short-term relief and encourage spending, there are broader implications. How will the loss of government revenue impact future funding for vital programs and services?

Targeted measures, such as direct cash transfers or enhanced tax credits, might prove more effective in supporting those who need the most help.

Whether purchases are made before or after December 14, qathet region businesses are in need of support, regardless of the GST holiday, so help out by shopping locally this holiday season, and afterward.

Join the Peak's email list for the top headlines right in your inbox Monday to Friday.