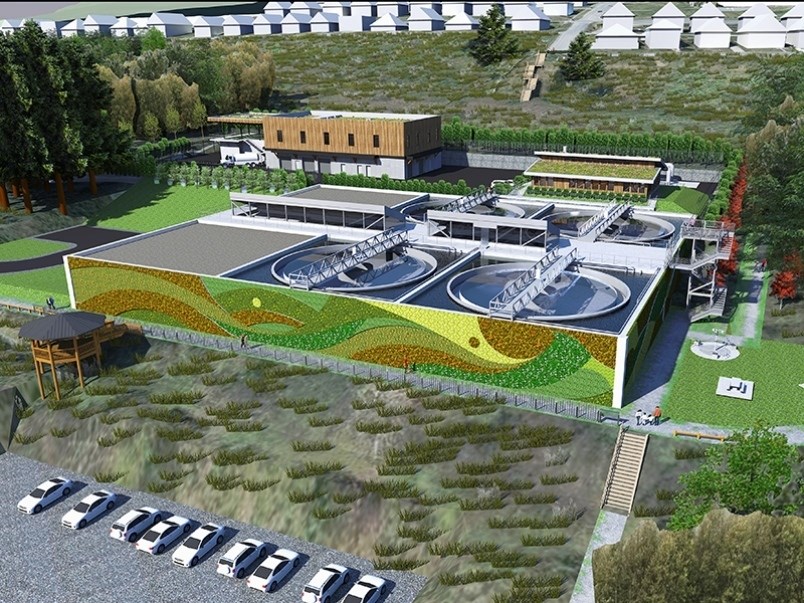

Borrowing of $10 million for Powell River’s liquid waste treatment plant is now in the works.

City of Powell River and qathet Regional District (qRD) have both processed necessary documentation and bylaws to apply for funding from the Municipal Finance Authority (MFA). The final steps in the process now lie with the regional district.

According to a staff report from qRD manager of financial services Linda Greenan, municipalities do not have the authority to borrow directly from the MFA. Greenan stated in her report that municipalities must authorize borrowing through loan authorization bylaws and regional districts borrow the money from the MFA on behalf of the member municipalities.

The regional district passed Security Issuing Bylaw No. 556 at its board meeting on December 18. The bylaw reads that the regional board consents to financing the debt of City of Powell River in the amount of $10 million. The bylaw notes that the city has a maximum amount of $27,280,000 authorized.

At the December 5 city council meeting, councillors approved sending the borrowing request to the regional district to consent to the city borrowing $10 million over a 30-year term.

The entire liquid waste project will require approximately $27 million in borrowing on behalf of the city, said councillor George Doubt, who is also chair of the city’s finance committee.

“The committee and the chief financial officer have consulted together and feel it’s appropriate to borrow $10 million at this time to ensure we get the advantages of low interest rates that exist right now,” said Doubt. “The chance of interest rates decreasing significantly is far less in my view than the chance of the interest rates increasing over the next four to five years.”

Doubt said the full loan might not be required if the project comes in under budget. Provincial and federal governments will be providing 73 per cent of the money required for completion of the liquid waste project, which could cost up to $70 million.

Greenan stated in her report that the MFA will hold its annual general meeting on March 26. She stated that because borrowing requests for the spring 2020 long-term debt issue will be reviewed at this meeting, regional districts need to submit applications for certificates of approval on security issuing bylaws to the ministry of municipal affairs and housing by February 14.

In terms of financial implications, on a schedule consistent with the debt payments issued by the MFA, the city will forward funds to qRD to cover the full cost of the debt payments. The revenue from the city and associated debt payment expenditure will be included in the qRD’s five-year financial plans until the debt is paid.

City chief financial officer Adam Langenmaier said what the regional district will do now is send the bylaw to the ministry for a certificate of approval.

“The ministry has already seen this bylaw because the city had to send the city’s bylaw to the ministry for approval, which was received back in the fall prior to the request from the city to the regional district for borrowing,” said Langenmaier. “Once the regional district receives the certificate of approval, it will send the bylaw and the certificate to the Municipal Finance Authority for including in the spring 2020 issue. The MFA will source funding and then forward the requested funds ($10 million) to the regional district and then the regional district forwards it to the city.”

Langenmaier said the city is uninvolved in the process until the city receives cash from the regional district after the spring issue.